Today, there is still nothing like a level playing field for open source and closed source software. Even so, regulators need to think about how they will recognize it, and then maintain a delicate balance afterwards. Recent research using mathematical economics shows that a mixed market in which open source and closed source companies coexist delivers the most value to society.

Unfortunately, analysis shows that equilibrium mixed markets consistently produce too many open source firms to maximize welfare. Many governments have turned their own major spending on software and accompanying services into a policy instrument — some more successfully than other — by establishing formal preferences (and even mandatory requirements) that systematically favour open source over closed source. Unlike the case of government provided open source code, however, this intervention could actually reduce welfare.

In this article we present research conducted by Sebastian von Engelhardt, who has developed an economic model to analyse market dynamics along the open source — closed source axis. In this model, firms produce and sell ICT products (goods and services) that consist of two complementary parts. The first is software, which can be open source or not, and the second consists of either hardware, services, or (proprietary) software, or a mix of these.

Mixed market

Today, there is still nothing like a level playing field for open source and closed source software. Even so, regulators need to think about how they will recognize it, and then maintain a delicate balance afterward. Recent research using mathematical economics shows that a mixed market in which open source and closed source companies coexist delivers the most value for society. This finding was published in 'The New (Commercial) Open Source: Does it Really Improve Social Welfare?', a paper — co-authored by Stephen Maurer — that is part of Sebastian von Engelhardt's dissertation. He is a post-doc at the Friedrich Schiller University in Jena, Germany, where he specializes in digital economics, IP rights, innovation and new institutional economics.

Von Engelhardt's research shows the value of a balanced market. Welfare in either a CS-only market — basically the condition that existed from 1945 to 1985 — or an OS-only market is lower than the level that can be reached in a mixed market.

The reason closed source software does not deliver the most value to society seems to be obvious,

von Engelhardt elaborates, the lack of code sharing results in a wasteful duplication of effort. That open source software is not welfare-optimal either, is less obvious. Beside the advantage of cost sharing, it also has a disadvantage: open source software helps firms to avoid competition, because shared code can no longer be used to differentiate one firm from another. Since the software is an important determinant for the product quality, code sharing enables firms to avoid quality competition at this level. This has nearly the same effect as an official quality cartel among OSS-using firms would have had: output is reduced while firm profits go up.

That is why von Engelhardt and Maurer call this phenomena the 'quality cartel' effect of open source software. Open source software is like a two-edged sword: it avoids cost duplication (good) but it implies a quality-cartel effect (bad). Therefore mixed markets are better: CSS-based firms do not share code, hence they compete on quality. This forces OSS-based firms to invest more in quality (i.e. software).

Quality cartel

A mixed market has its welfare-optimal ratio of OSS-based and CSS-based firms when both effects (cost duplication of closed source software versus quality cartel effect of open source software) balance each other in an optimal way. Unfortunately, the ratio of open source to closed source companies that provides the highest welfare — a situation that requires a lot more of the former than the latter — is not stable. In those circumstances, further OSS-based firms will enter the market, until in market equilibrium there are far more OSS-based firms compared to the socially desired ratio. In extremo, production is suppressed drastically until closed source companies are present in sufficient numbers to enforce quality competition.

According to von Engelhardt, the quality cartel is a new concept that was not seen in earlier models. Another interesting finding is that procurement preferences which concentrate government spending on open source software actually increase the mismatch between the equilibrium and the welfare-optimal ratio. Although von Engelhardt would never propose taxing open source firms, tax regimes which transfer profits from open source to closed source companies and governments provisioning open source code would be better options to prevent open source from dominating the market.

A two-stage model

In his research von Engelhardt uses a two-stage economic model which combines competition in quantity (selling ICT products) on the one hand, and competition (CSS) or cooperation (OSS) in quality on the other. The basic model is developed in 'Quality Competition or Quality Cooperation? License-Type and the Strategic Nature of Open Source vs. Closed Source Business Models' (including liberal and restricted licenses), while the following welfare and policy analysis is done in 'The New (Commercial) Open Source: Does it Really Improve Social Welfare?', co-authored by Stephen Maurer.

In stage one firms decide whether and how much to invest in software development (the quality decision). For open source software two IPR (Intellectual Property Rights) regimes are distinguished. Liberal licenses (copyfree, e.g. the BSD licenses) permit the mixing of open source with closed source code. Restricted licenses (copyleft, e.g. the GNU GPL), on the other hand, prohibit any mixing of open source and closed source code at stage one, forcing firms to choose the one or the other. So in the case of a liberal license software is developed as a mix of open source and closed source code, and in the case of a restricted license software is developed either as open source or as closed source code.

In stage two oligopolistic quantity competition takes place. Here, firms combine their stage one software with their stage two products (e.g. hardware, services, and proprietary software) into horizontally (distinctively) and vertically (qualitatively) differentiated bundles. These form the foundation for the (Cournot) competition that will determine profit-maximizing quantities. The most important difference between open source and closed source in this context is the sharing of the (quadratically scaling) software development costs. So choosing to develop open source code implies a decision to cooperate rather than to compete on quality.

CS-only and OS-only markets

In a CS-only market, software development is boosted by quality competition: closed source software is a differentiator. In an OS-only market, firms share all software, so the average per-firm development costs are lower for open source compared to closed source firms (cost sharing). A firms that makes its own bundle more attractive, however, also strengthens its competitors (benefit sharing: open source software cannot be a differentiator). This suppression of quality competition implies that firms in OS-only industries would always earn higher profits than firms in CS-only industries for a given number of incumbents. So, assuming free entry, OS-only industries are expected to have more incumbents: there is more margin to go around.

For both OS-only and CS-only markets the amount of software produced decreases as quantity competition increases: products increasingly substitute each other. In extremo: if products are completely differentiated, then all firms are monopolists in their own (sub)markets. If products are perfect substitutes, then competition is strong and firms tend to compete away any profits. This reduces benefits from quality improvements, even more so for open source software.

Although cost sharing allows OS-only markets to produce more software than CS-only markets when quantity competition is modest, production falls steeply as greater product substitutability leads to increased quantity competition between firms. This quality cartel effect — open source firms do not compete on quality — in the end causes OS-only industries to offer less software per bundle than CS-only industries.

Analysis

Von Engelhardt analysed the three basic positions along the open source — closed source axis: an OS-only market, a CS-only market, and a mixed market, at the same time examining the effects of liberal and restricted licenses. His main findings show that most OS-only markets and most CS-only markets are stable, prohibiting the welfare-superior mixed markets from ever developing. Furthermore, stable mixed markets hardly ever contain enough closed source companies to enforce optimal quality competition among open source firms.

Except for industries that are very separated (having a high degree of horizontal product differentiation), liberal licenses prohibit commercial open source software from appearing in a mixed market. In this case, firms only develop open source code when the degree of quality competition is low. Otherwise, a public good dilemma occurs: firms use open source code if it exists but only produce closed source code. Restricted licenses are therefore required to ensure commercial open source output.

Liberal licenses make it easier to free-ride

, von Engelhardt explains. You produce some open source code. I take this, and use it for free, but my product is closed source. Then I compete with you, and exploit you. Restricted licenses make this harder. When I further develop the code (and sell the ICT product that contains that code), I have to put the code again under the restrictive license, and thus anyone can benefit from this contribution. This is the economic logic of the model. In the real world, however, liberal licenses work better than in the model, because there are other reasons why firms contribute even to liberally-licensed open source software. For example, there can be technical reasons — i.e. it has to be implemented as part of the kernel — or firms may be 'punished' by the community if they only exploit — i.e. the community stops cooperating with the firms and no longer helps them.

Market equilibrium

Assuming free entry and exit of firms, and ignoring possible historical events that could give rise to lock-in, analysis of a mixed market with restricted licenses shows that in an equilibrium (where all existing firms are making a profit and new entrants would lose money) a few closed source companies compete with many smaller open source firms. Furthermore, these closed source companies offer higher quality (more code per bundle) than open source firms. And when the products are close substitutes, they have the larger market share.

When the stage two product has lower quality (e.g. mobile phones with fewer hardware features), the software decision becomes more important. When the complementary private good is less important for generating revenues, the stage one software becomes more valuable. Although fewer companies choose open source business models in this scenario, the remaining open source firms have a stronger incentive to develop code because of quality competition with the closed source firms. So they offer higher quality and gain a larger market share.

When the marginal costs of software development increase more steeply (i.e. developing new code becomes 'more costly sooner'), the number of open source firms and their market share is even higher, because the benefits of cost sharing and quality cooperation become more important.

Mixed market dynamics

In a mixed market, closed source firms react to increased software development by other firms as a strategic substitute. Since open source companies compete with closed source companies on quality, they also see increases in closed source production as strategic substitutes. The strategic interaction among open source firms, however, is different. The presence of closed source companies prevents open source firms from cartelizing around a low level of quality. Instead, open source firms must compete on quality against these closed source companies outside the cartel. This makes the ability to share costs more valuable to open source firms.

When open source firms remain a small minority, strong quality competition from closed source companies encourages them to use their cost-sharing advantage to produce large amounts of open source software. Because closed source companies do not share costs, they cannot match the maximum potential software output that open source firms can achieve. Furthermore, they react to open source development as a strategic substitute. So now the closed source companies will specialize in selling low-quality bundles at a low price.

Increased opportunities for cost sharing continue to dominate diminished quality competition as the proportion of open source firms grows, until the declining number of closed source companies suppresses quality competition. Then the open source quality cartel becomes so strong that open source firms produce very little code. So now the situation has reversed, and closed source companies have replaced the open source firms as the industry's high-quality, high-priced providers.

Welfare of pure markets

Total welfare — driven by quality difference and cost difference — in a pure market depends on the amount of quantity competition. Since open source firms can share code, whereas each closed source company must create its own code, OS-only industries are welfare-superior in the case of low quantity competition. In this case, OS-only industries produce much more code and therefore incur higher costs, but this effect is never large enough to overcome the quality and cost-sharing advantages associated with open source.

For moderately large and higher quantity competition, the greater code production associated with CS-only industries dominates the cost advantages of shared open source production so that closed source now delivers superior welfare. In case of very high quantity competition, when competing products are very close substitutes, however, the code output and associated costs in CS-only industries increases sharply, making the OS-only industries once again welfare-superior.

Welfare of mixed markets

Compared to mixed industries in which open source firms greatly outnumber closed source companies (at the top of the diagram), CS-only industries are superior for the same reasons that they dominate OS-only industries. As industries become more concentrated, this area shrinks and eventually disappears, because open source firms can now appropriate value despite high quantity competition.

In the situation where products have low substitutability (at the left of the diagram), the open source firms can recover their "public" investments because markets are separated. This region where OS-only industries are the best grows when industries becomes more concentrated, i.e. when the number of firms in the market decrease.

Finally, when closed source companies outnumber open source firms in industries with very similar products (close substitutes) (at the lower right of the diagram), only pure states may be possible. In a mixed market strong competition would limit the open source firms' ability to appropriate profits from improved products, while at the same time the small number of open source firms limits the savings otherwise available from shared development. In this case, the best strategy for open source firms facing closed source competition would be to produce no software at all. Comparing CS-only industries and OS-only industries shows that the CS-only state would be welfare-superior here.

In conclusion, suitably-chosen mixed industries are almost always welfare-superior to OS-only or CS-only industries. These mixed states are welfare-superior because they feature enough open source firms to efficiently share costs and enough closed source companies to induce quality competition.

Welfare maximization

In this section we look at the case in which the total number of firms is large. In such a mixed industry there are generally far more open source firms than closed source companies. In particular, the number of open source firms is very much greater than the number required to maximize welfare. Closed source companies, on the other hand, tend to have larger market shares than open source firms, and this is especially true where firms' products are close substitutes (i.e. in the case of high quantity competition).

Lock-ins

We have just claimed that welfare optimality requires mixed states. If a particular industry starts or ends up in an OS-only or CS-only state, however, welfare improvements are bounded unless the industry can transition to a mixed state.

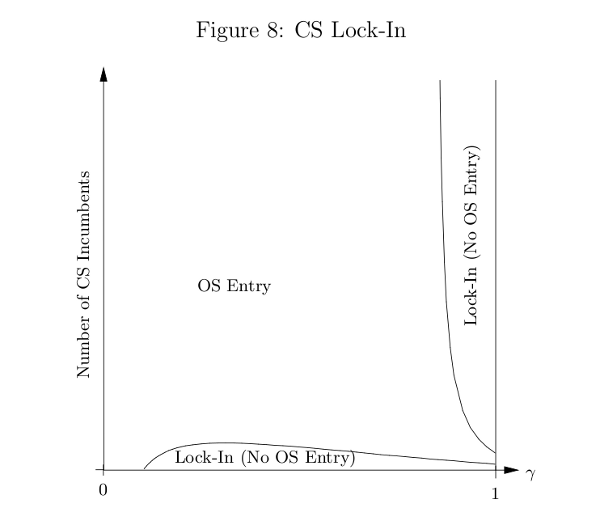

As the diagram shows, OS-only industries can be locked in, but only where substitutability (quantity competition) or the number of open source incumbents is small.

The diagram shows that CS-only states are stable only for concentrated industries (i.e. those having a low number of incumbents), most characteristic of Silicon Valley, and industries whose products are close substitutes (i.e. they have high quantity competition).

Furthermore, companies in some of these CS-only industries can deliberately stabilize their industries in this state, and so prevent the erosion of oligopoly profits. In these cases, adopting an open source strategy by the incumbents would open up the market to further entry by open source firms. After that, industry profits would fall.

According to von Engelhardt, this logic can give valid strategic reasons why a company like Microsoft rejected and fought open source for years. Given that I'm a dominating firm, I know that with closed source there is no further entry, neither OS-based nor CS-based, and I can gain some nice profits. I also know that if I would switch to open source, this would induce entry and reduce my profits. Therefore I have no incentive to use open source.

Government interventions

The diagram shows that stable markets (solid line) contain far more open source firms than the number needed to optimize welfare (dash-dotted line). This dramatic mismatch between the OS:CS ratio expected in equilibrium and the desired welfare-optimizing ratio is a central result of von Engelhardt's research, and poses an important challenge to policy makers.

Taxes

One option would be for governments to use tax policies to change industry output of open source and closed source code. Since market forces in mixed industries invariably deliver far more open source firms than welfare optimization requires, governments should be suspicious of typical proposals to foster open source as an infant industry, say through special tax breaks. On the contrary: in the model world the most obvious way to improve welfare were to tax open source firms and to give breaks to closed source firms.

In the real world, however, government is not able to estimate the welfare-optimal OS:CS ratio and proper taxation with any degree of precision. In this case, ambitious transfer schemes could easily end up over-taxing open source firms and over-subsidizing their closed source competitors. However, the model has a clear message for real-world politics: there is no theoretical justification for giving tax breaks to OSS-based firms.

Provisioning of OSS

Government can also intervene by directly boosting open source software supply over and above what the market supplies. As a matter of fact, many countries have established different institutes, collaborations and partnerships to fund open source software development and adoption; and government-paid research grants may require academia and industry to publish code as open source software. Finally, in principle government could also pay contractors directly to write open source code.

Analysis of CS-only markets where incumbents would otherwise be able to block entry by open source firms, shows that government-supplied open source code reduces entry costs to a level where an open source sector can establish itself.

Government funding in mixed industries takes place at two levels. The first level occurs entirely within the private sector, where government-supported open source code has two effects. It makes open source firms more profitable so that their number increases. Moreover, it reduces open source firms' incentives to produce their own code — government-supported open source code crowds out private investment — so that the welfare-optimal ratio falls. The net result is to make the already-large mismatch between the equilibrium and desired OS:CS ratios even worse.

The second effect takes place across the entire economy. The new government-supplied code writers can be thought of as an additional open source supplier that chooses output based on government fiat instead of the Cournot market model. That allows you to benefit from cost-sharing (avoid cost duplications) without suffering from the (private incentive based) cartel effect. This increases the level of welfare in any case.

As net result, government provided open source software increases welfare.

Procurement policies

Many governments have turned their own major spending on software and accompanying services into a policy instrument — some more successfully than other — by establishing formal preferences (and even mandatory requirements) which systematically favour open source over closed source products. This provides a powerful incentive for new open source entrants in cases where CS-only industries would not otherwise evolve into welfare-improving mixed states.

In mixed markets, however, this intervention could actually reduce welfare. Analysis shows that the new equilibrium has lower welfare than the equilibrium characterizing a neutral government. Conversely, government procurement preferences for closed source software yield the opposite results and so increase welfare.

Conclusions

Governments can use various policy instruments to improve welfare by reducing high equilibrium proportions of open source firms. These include competition (antitrust) policy, taxation and tax breaks, government-funded open source development, and government procurement preferences. Of these, tax policy provides the most natural instrument for achieving the target proportion needed to optimize welfare through private sector investment. By contrast, government-provided open source code actually increases the gap between the desired and actual OS:CS ratios and depresses private open source investment still further. Despite this, government-funded open source code still improves social welfare by boosting the total (private + government) supply of open source. Government procurement preferences for open source have the worst outcome: they not only increase the gap between the desired and equilibrium OS:CS ratios but also reduce total welfare.

However, government could do a lot more to support 'neutrality' or 'equal chances',

von Engelhardt says. For example, when teaching how to use computers in school, teachers should at least tell children that there is not only Microsoft and Windows, and that this concept of closed source vs. open source exists.

Research conclusion

Von Engelhardt's research shows that OS-only industries are welfare-superior to CS-only states so long as quantity competition is modest, so that appropriability is high. Otherwise, CS-only industries are welfare-superior except in cases of nearly-identical products with thus strong quality competition. Finally, mixed are superior to both OS-only and CS-only industries. This is because the presence of closed source firms introduces quality competition which induces open source firms to produce much more code than they otherwise would. So, open source is only able to realize the full benefits when closed source companies are present.

Unfortunately, analysis shows that equilibrium mixed states consistently produce too many open source firms to maximize welfare. Additionally, many pure markets are stable and cannot transition to the mixed markets needed to improve welfare. In some cases, incumbents can also deliberately block entry by choosing closed source.

Policy makers trying to improve welfare can cope with these problems in several ways. Probably the most elegant (and also revenue-neutral) proposal is to tax open source firms and use the proceeds to subsidize their closed source rivals. However: It's fundamentally important to distinguish between model-world outcomes and real-world policy advice,

warns von Engelhardt. In the model, government can calculate optimal taxes and tax breaks, while in reality we cannot. I would thus certainly not advice governments to tax OS-based firms. But this does not mean the theoretical model is useless for practical advice. The model provides no argument in favour of interventions that selectively support OS-based firms; on the contrary. Therefore, real-world policies should not use any of such pro OS-firm measures. There is, however, one exception: government-supplied open source software is good for welfare. So a government could for example declare that code produced by universities should be published as open source software.

According to von Engelhardt, the model basically teaches us that:

- mixed markets are better than pure;

- pro OS-firm interventions lack theoretical support and should be avoided;

- policy measurements that directly increase the supplied open source software (not supporting the firms) like OSS requirements for universities are beneficial, i.e. increase total welfare;

- and finally, that if there are persisting pure markets, then interventions may make sense, but if and which ine should be based on a case-to-case base; there is no one-size-fits all solution.

Overcoming pure markets

Although von Engelhardt's research paper states that for CS-only industries procurement preferences (and even requirements) can be a powerful tool for promoting OS entry that would not otherwise occur, he would advice against it for real-world policies. In the model it would work like that. Government could calculate optimal intervention, and get rid of the pro-OS procurement preferences as soon as the transition to a mixed market is done. Unfortunately, we are not living in a model world.

For the real world, I see two general arguments against procurement preferences:

-

It is always a bad idea to mix up things. Government procurement should be about how to purchase stuff government needs at best price (don't waste tax payers' money), not about market outcomes. If you want to correct market outcomes, use taxes and subsidies, unless there are better ways to do it (e.g. providing information).

-

Procurement preferences are typically hardly ever 'temporary'. In principle you introduce them to overcome a problem, which implies that you should get rid of them as soon as the problem is solved. But in reality they are quite likely to persist (just like 'temporary' subsidies).

So the first question to ask is where do you think today are still CS-only markets? Then if you really identify one, be sure that:

- there will be no entrepreneurs (i.e. start-ups, maybe with new, closely-related 'products') that can break this up. As my research on start-ups shows: OS-based start-ups are very common nowadays, and open source software can even lower the barriers to enter.

- OS-based business models would make sense (i.e. there is a reason why it is hard (or impossible) to make money with open source in the office suite market for consumers (private persons) who typically only buy basic office software and need no service or Premium versions). Then check whether other policy measures would also work, and try to use the measure that fits best. But I think you should decide this on a case-to-case basis.

So I don't think pro-OS procurement preferences are always the best way to move away from a CS-only extreme,

von Engelhardt concludes. They tend to persist rather than be temporary, so you should check on a case-to-case basis which other policy measures would work best. In addition: don't underestimate the change and dynamics of ICT markets. Can we actually find really persistent CS-only markets?

Jimmy Schulz: give open source a fair chance

Jimmy Schulz, a member of the German parliament (the Bundestag) for the liberal FDP, thinks that neither open source nor closed source should be favoured. Establishing procurement policies that state a preference for open source is wrong. You should not select software depending on its license model. We deploy software to do a job. So you start with its functionality, then comes its price, and then the Total Cost of Ownership (TCO). The license is part of the latter. Don't get me wrong: I'm a huge fan and user of Linux and open source software myself, but that's a personal choice. For public use, open source and closed source should be considered equally.

Schulz admits, however, that proprietary software is still wrongfully favoured, to the detriment of open source software. The policies to create a level playing field for the both were installed over ten years ago, but they are ignored. We realize there are problems to be solved. That's why the German parliament has established a list of fourteen recommendations as part of a parliamentary inquiry on internet and digital society.

Schulz was leading the project group responsible for interoperability, standards and open software. Four of the points in this list of recommendations specifically relate to open source:

- The migration and operation of open source and proprietary software in the public administration represent versatile and extensive challenges that require continuous monitoring. The commission recommends that the federal government provides the Competence Center for Open Source Software at the federal administration office with sufficient means, so that it can continue to serve as competent contact person.

- During the preparation of procurements an over-all assessment must be conducted to ensure that the principle of neutrality is maintained and that neither open source nor proprietary software is favoured. The commission notes, however, that there may be objective reasons — particularly following from TCO analysis — which make the use of open source software in public administration preferable.

- The commission asks the federal government to examine how changes in the federal procurement policies can make it easier for third parties providing open source software to participate in public tenders. Specifically, it should be examined whether conditions for the approval of exceptions are present.

- The commission acknowledges that verticals-specific software is needed to accomplish time savings and increased efficiency in management and control of business processes, and in customer service. In many industries, however, choice in software is currently limited. So the commission suggests that professional associations make existing standards and specifications available, so they can be used by both proprietary and open source providers. Furthermore, certifications should be available to anyone at low cost, in order to create equal market conditions.

To Schulz, however, not the licensing model but interoperability through open standards is the starting point. We should avoid lock-ins from which we cannot escape. Why would you use Microsoft's proprietary docx format for documents when others cannot open it and OpenDocument (the Open Document Format, ODF) is readily available? So, different software packages should adhere to open standards and work together. And we have to create a fair market for proprietary and open source software. So we do have to change some things. We should not, however, create discriminating policies, but we should give open source a fair chance.

Further reading

- Interview with Sebastian von Engelhardt: "Open source as a business model", www.patentanwalt.cc;

- Sebastian von Engelhardt (2010): "Quality Competition or Quality Cooperation? License-Type and the Strategic Nature of Open Source vs. Closed Source Business Models", Jena Economic Research Papers, 2010-034;

- Sebastian von Engelhardt and Stephen Maurer (2010): "The New (Commercial) Open Source: Does it Really Improve Social Welfare?", Goldman School of Public Policy Working Paper, No. GSPP10-001, Berkeley;

- Sebastian von Engelhardt, Andreas Freytag, and Stephen Maurer (2010): "Open vs. closed source software: The quest for balance", www.voxeu.org, 29. Oktober 2010.